Accounts receivable (AR) management directly affects the revenue stream and financial stability of an organization. The amount of money clients owe a business for goods or services that need to be paid is known as accounts receivable. Effective accounts receivable processes are essential to maintaining a sufficient balance sheet and ensuring the business runs smoothly.

Accounts receivable are considered current disadvantages on an organization’s balance sheet. It reflects the anticipated amount to be received within a year. It’s essential to a company’s short-term financial soundness. Ensuring that clients pay their bills on time is accounts receivable management’s (AR) main goal. This gives the business the cash flow it needs to fulfill its commitments and make investments in growth opportunities.

Effective Accounts Receivable Management’s Value:

Accounts receivable need to be managed effectively for several reasons:

Cash flow:

Accruing receivables on time secures a consistent flow of funds. It needs to pay operating costs and make investments in the organization’s expansion.

Credit Risk:

Effective accounts receivable management makes it more comfortable for the client to consider and reduces the chance of late or non-payment by clients.

Customer Relationships:

Efficient receivables management improved client relationships by maintaining concise communication and fair credit policies.

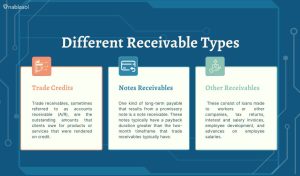

Different Receivable Types:

Receivables are outstanding bills a business has after offering products or services on credit, as defined by accounting. They are an essential part of a business’s financial situation since they signify a client’s or customer’s entitlement to payment. Trade receivables, notes receivable, and miscellaneous accounts receivable. These are the three primary categories of receivables.

1. Trade Credits:

Trade receivables, also known as accounts receivable (A/R). Clients owe these outstanding amounts for products or services rendered on credit. These balances are due in a short amount of time—30, 60, or 90 days. Trade receivables are categorized as current acquisitions on the financial report of a business. They include a large portion of its financial resources and liquidity.

2. Notes Receivables:

One kind of long-term payable that results from a promissory note is a note receivable. These notes typically have a payback duration greater than the two-month timeframe that trade receivables typically have. The promissory note is a legal document supporting the debtor’s claim to payment. These notes bear interest, and the time frame for repayment can be separated. Which are present and long-term elements on the balance sheet.

3. Other Receivables:

Other accounts receivable contain various kinds of receivables that do not fall under the classifications of trade or notes receivable. These consist of loans made to workers or other companies, tax returns, interest and salary invoices, employee development, and advances on employee salaries.

The Value of Accounts Receivable Management:

There are multiple reasons why accounts receivable management needs to be done well:

Cash Flow Management:

Receiving is an important source of cash flow for businesses. Effective management of them guarantees a consistent flow of money, which is necessary to cover operating costs and preserve financial stability.

Financial resources and liquidity:

Receivables are classified as current assets because they are expected to be turned into revenue within a year. Through efficient receivables management, the company maintains sufficient working capital.

Financial Health:

Receivables, which stand for a company’s entitlement to obtain payment from clients, are extremely important to its overall financial health. Managing receivables well ensures that the company can continue to operate and pay its debts.

Accounting Receivables’ Effect on Financial Statements:

Accounts receivable significantly impact the financial statements of a business:

Balance Sheet:

AR is classified as a current asset, influencing the company’s liquidity and working capital.

Income Statement:

Prompt collection of receivables helps to recognize revenue and increase profitability.

Cash Flow Statement:

The cash flow from working activities includes the amount accumulated from receivables.

Barriers to Accounts Receivable Processes:

Even with their significance, accounts receivable processes can be difficult because of:

Payment Delays:

Receivables can be complicated. It can encompass many receivables and payment periods. Also necessitates close administration and oversight.

Credit Management:

Keeping a healthy balance of receivables requires managing credit risk and choosing suitable lending conditions.

Credit Risk:

The chance that clients won’t pay can result in accounts that are uncollectible, which can negatively impact the cash flow and financial stability of the business.

Automation of Accounts Receivable: A Fix for Often-Faced Problems

A lot of businesses are using accounts receivable process automation to resolve these issues. Automatic AR systems have several advantages.

Efficiency:

Automation streamlines the invoicing and collection procedures, minimizing the need for manual labor.

Accuracy:

Automated methods reduce human mistakes in payment recording and invoicing.

Visibility:

Real-time receivables tracking helps to provide better insight into the company’s cash flow.

Automation and Technology for Accounts Receivable Management

Technology and Automation in Accounting Software for automating accounts receivable can assist companies in managing their receivables more successfully and efficiently. By streamlining procedures like invoice creation, payment tracking, and collections, these software programs can cut down on manual labor and mistake rates. Furthermore, by utilizing technologies like artificial intelligence and machine learning, businesses can better manage their receivables by predicting payment patterns and identifying any dangers.

Monitoring your clients’ outstanding payments includes keeping track of internal procedures, credit policies, billing, invoicing, processing payments, and client contacts. The goal of managing accounts receivable is to simplify invoicing, payments, and collections to cut down on payment times as well as lower the chance of bad debt, guarantee on-time payments, and prevent late payments. Receivables management is critical for a company’s cash flow and overall financial health. This includes training employees on best practices, sustaining reliable client data, conducting regular process assessments, simplifying workflows, and implementing accounts receivable processes.

While ineffective management might result in underutilized personnel, using best practices in account receivable administration can help your company receive payments on schedule, maintain positive client relationships, and have high liquidity. Streamlining accounts receivable processes, utilizing the right key performance indicators (KPIs), training employees, maintaining accurate details about customers, conducting regular operation reviews, simplifying workflows, and automating accounts receivable are all necessary steps to enhance accounts receivable management and ensure effective payment collection.

Conclusion

The conclusion of Nablasol’s accounts receivable information underlines the importance of using accounts receivable solutions to improve financial efficiency. Businesses can maximize their overall profitability and increase cash flow management. Streamline their financial operations by automating difficult accounts receivable procedures. With the strategic approach provided by Nablasol’s solutions for accounts receivable management, businesses can effectively manage delinquent invoices. Not just that, it can also keep an eye on liquidity and improve its capacity to meet short-term obligations. Overall, by offering automation, insights, and tools to efficiently handle receivables and guarantee financial stability and growth, accounts receivable software may completely transform financial operations.